Top 5 Retirement Planning Mistakes

Author by Chris Draughton, CFP

Are you planning to fail or failing to plan?

Are you planning to fail or failing to plan?

As you consider your finances, it is important to ask yourself this question: When it comes to your financial well-being, are you planning to fail or failing to plan?

Here are the top five planning mistakes when it comes to your retirement:

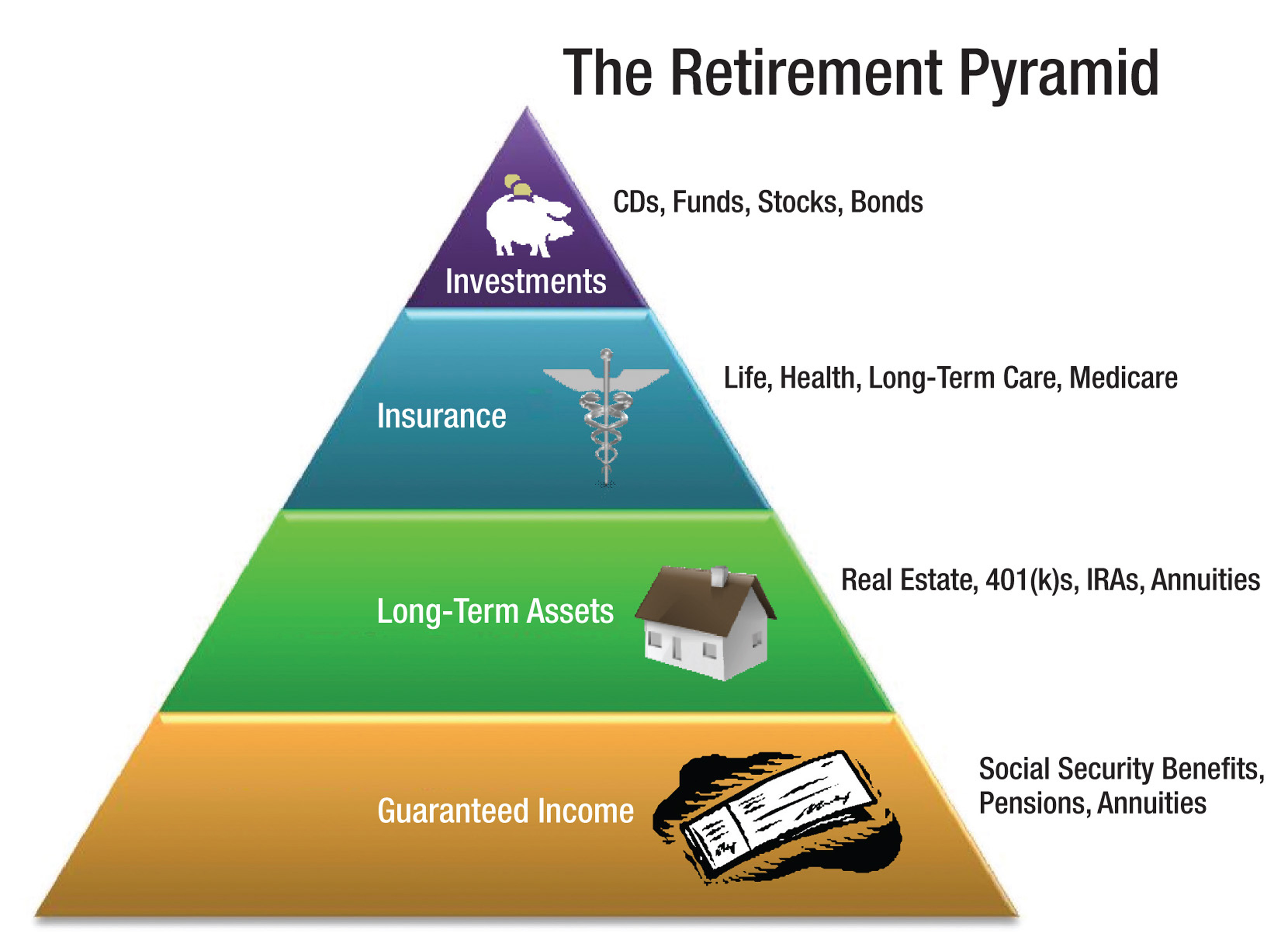

1. Taking social security too early: Three out of four Americans claim their retirement benefits early, most of the time as early as they can when they turn 62. You can increase your lifetime income by as much as 30 percent and increase your take-home pay by 30 percent, simply by delaying your benefits.

2. Outliving your assets: The good ol’ days are now the good ol’ years. The retirement model was originally based on shorter life spans with people living only about 15 years as a retiree. It’s a blessing and a curse, but we’re all living much longer, many people into their 90s. Living longer can wreak havoc on a financial plan if you don’t plan for it.

3. Failing to plan: We should call this one failing to dream. Let’s be honest. We all look forward to retirement so can do all those things we didn’t have the time to do as working citizens – travel, play golf, spend time with the grandkids, dine out, go to movies. We’re living longer and we’re healthier than ever which means our lifestyles tend to be more active, and thus more costly, during retirement. This is a starting point at FCWA when working with a client. We start with that dream lifestyle and work our way backwards to help you achieve it.

3. Failing to plan: We should call this one failing to dream. Let’s be honest. We all look forward to retirement so can do all those things we didn’t have the time to do as working citizens – travel, play golf, spend time with the grandkids, dine out, go to movies. We’re living longer and we’re healthier than ever which means our lifestyles tend to be more active, and thus more costly, during retirement. This is a starting point at FCWA when working with a client. We start with that dream lifestyle and work our way backwards to help you achieve it.

4. Not having a healthcare strategy: This is a temperamental topic these days, but also reinforces the point that your plan needs to account for medical costs. Aside from expenses you can plan for – co-pays, prescriptions, and hospitalization – we all encounter unexpected medical circumstances that can take a huge chunk out of savings. Also, many of you have heard me preach about the importance of having a long-term care strategy – that’s a key factor to plan for as we live longer.

4. Not having a healthcare strategy: This is a temperamental topic these days, but also reinforces the point that your plan needs to account for medical costs. Aside from expenses you can plan for – co-pays, prescriptions, and hospitalization – we all encounter unexpected medical circumstances that can take a huge chunk out of savings. Also, many of you have heard me preach about the importance of having a long-term care strategy – that’s a key factor to plan for as we live longer.

5. Scheduling your annual checkup: We’re not talking about your annual physical exam. I’m talking about your annual financial checkup. A lot of changes can occur in a year – unanticipated healthcare expenses, changes in tax laws, rising investment income, changes in familial relationships.

5. Scheduling your annual checkup: We’re not talking about your annual physical exam. I’m talking about your annual financial checkup. A lot of changes can occur in a year – unanticipated healthcare expenses, changes in tax laws, rising investment income, changes in familial relationships.

6. About the Author

As a Certified Financial Planner (CFP), Chris Draughton serves as First Coast Wealth Advisors Director of Financial Planning and specializes in investment management, asset protection, retirement planning and estate planning.

A native of Northeast Florida, Chris is committed to helping clients achieve their personal financial objectives by identifying their unique needs, helping them create meaningful goals, and implementing strategies that achieve results.

A native of Northeast Florida, Chris is committed to helping clients achieve their personal financial objectives by identifying their unique needs, helping them create meaningful goals, and implementing strategies that achieve results.

Chris serves as the Chairman of the Government Relations Committee for the Financial Planning Association® of Florida. He is active in the community and serves as the President of the Ancient City Lions Club. Chris resides in St Johns County with his wife, Jennifer, and daughter, Olivia.