India’s Economic Journey: “Fragile Five” to “World’s Fastest Growing Economy”

By Dr. Sunanda Basu

In 2013, a little-known research analyst at Morgan Stanley coined the term “Fragile Five” in reference to the emerging market economies of India along with other four countries. As usual the New York Times without consulting any other economists was quick to report that India has become too dependent on foreign investment to finance their growth ambitions.

But in 2014, something unusual happened. Indian voters overwhelmingly supported the Bharatiya Janata Party, led by Narendra Modi, giving them a landslide victory. History was scripted in the forecourt of Rashtrapati Bhawan on the evening of May 26, 2014, as Narendra Modi took oath as the Prime Minister of India after receiving a historic mandate from the people of India.

Image Courtesy: X.com

In Narendra Modi, the people of India see a dynamic, decisive, and development-oriented leader who has emerged as a ray of hope for the dreams and aspirations of a billion Indians. His focus on development, attention to detail, and efforts to bring a qualitative difference in the lives of the poorest of the poor have made Narendra Modi a popular and respected leader across the length and breadth of India.

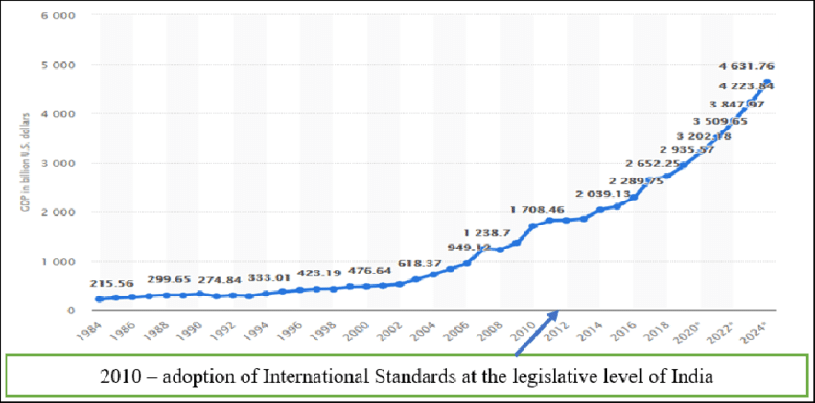

Fast forward to 2024, Prime Minister Modi delivered what he promised in 2014 to the people of India. Under the visionary leadership of Prime Minister Modi, India has undergone a significant metamorphosis. This transformation has positioned India as an economic model of hope and opportunity. Over the past decade, the country has evolved from being one of the “Fragile Five” economies to becoming one of the world’s fastest-growing economic powerhouses.

India is setting its sights high with a clear and strategic plan that combines economic reforms, technological advancements, and social programs. This comprehensive approach aims to propel the country to developed nation status by 2047, coinciding with the 100th anniversary of its independence. The ambitious goal is bolstered by India’s current status as the world’s fastest-growing major economy, with projections suggesting it will rank among the top three economic powers by 2030. The nation’s robust democratic system and strong international partnerships are considered key factors contributing to this anticipated success.

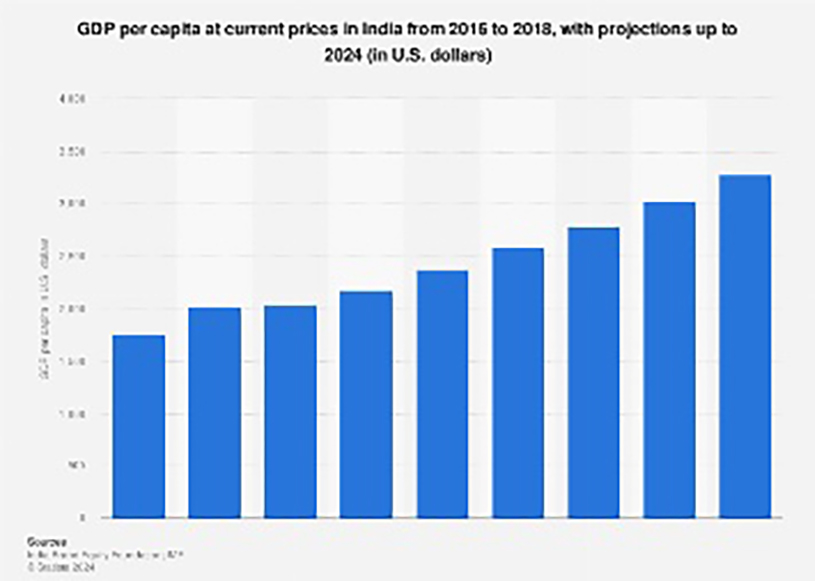

The significant economic growth observed in the first quarter of the financial year 2023 played a pivotal role in elevating India to the position of the world’s fifth-largest economy. This remarkable progress follows a robust recovery from the economic disruption caused by the COVID-19 pandemic. India’s nominal GDP, calculated at current market prices, is expected to reach US$ 3.52 trillion in 2023-24, compared to US$ 3.23 trillion recorded in the revised estimates for 2022-23.

Image Courtesy: X.com

Several factors are credited with driving this economic expansion. Strong domestic demand for both consumption and investment goods is a significant contributor, alongside the Indian government’s continued focus on capital expenditure. Data from the first half of FY24 highlight these factors as key drivers of GDP growth. During the January-March 2024 period, India’s exports reached US$ 119.10 billion, with engineering goods, petroleum products, and organic and inorganic chemicals leading as the top three export commodities. Additionally, rising employment opportunities and increasing private consumption, fueled by positive consumer sentiment, are expected to further support GDP growth in the coming months.

The Indian government’s future investments in infrastructure and asset-building projects are expected to be facilitated by several factors. These include tax buoyancy, a streamlined tax system with lower rates, a thorough review and rationalization of the tariff structure, and the digitization of the tax filing process. In the medium term, this increased capital spending is projected to act as a multiplier, further accelerating economic growth. The contact-based services sector, which has shown promise in terms of pent-up demand, is also seen as a potential growth engine.

The current period of global uncertainty and volatility has only strengthened India’s appeal as an attractive investment destination. The record-breaking amounts of capital raised by India-focused funds in 2022 stand as a testament to the strong investor confidence in India’s “Invest in India” narrative. This growing faith in the Indian economy serves as a powerful tailwind propelling the country towards its ambitious goal of becoming a developed nation by 2047.

RECENT DEVELOPMENTS

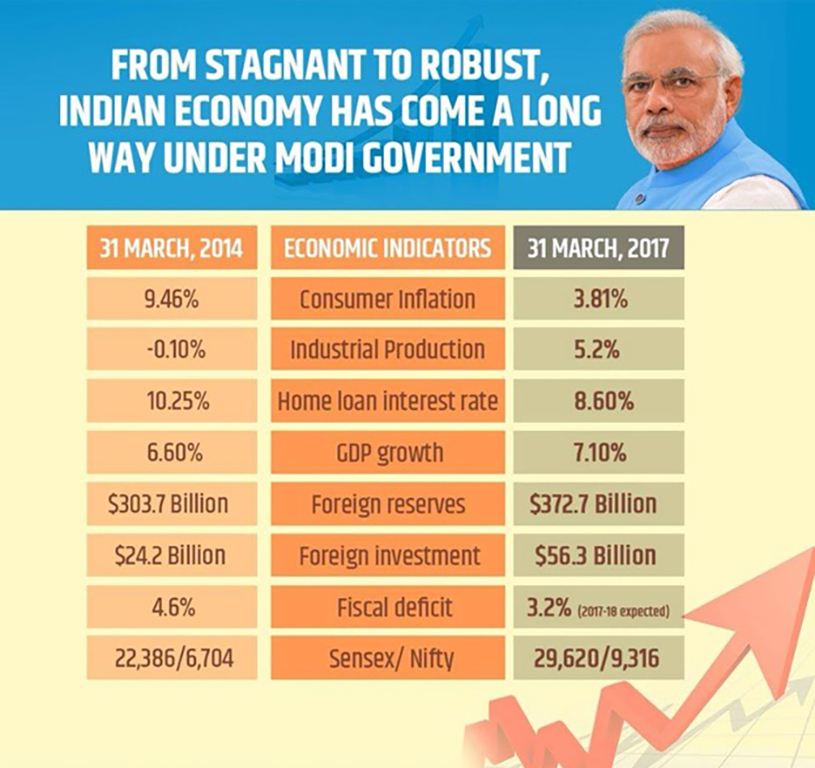

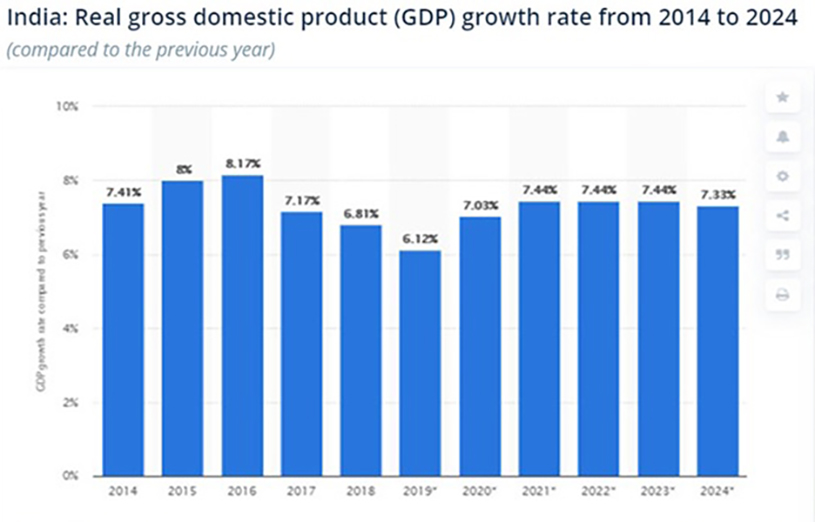

Ten years ago, India’s economic path was fraught with uncertainty. The nation faced several weaknesses in its economic structure and was highly susceptible to external economic pressures. However, under the astute guidance of PM Modi’s leadership, India has embarked on a remarkable economic journey. Between 2014 and 2022, India’s GDP has grown at an impressive compound annual growth rate of 5.6%, surpassing the growth rates of many other economies.

Ten years ago, India’s economic path was fraught with uncertainty. The nation faced several weaknesses in its economic structure and was highly susceptible to external economic pressures. However, under the astute guidance of PM Modi’s leadership, India has embarked on a remarkable economic journey. Between 2014 and 2022, India’s GDP has grown at an impressive compound annual growth rate of 5.6%, surpassing the growth rates of many other economies.

This growth has been achieved despite numerous global economic challenges. India has emerged as a beacon of stability and progress, attracting international investment and creating a favorable environment for businesses to expand their operations.

India’s economic engine is primarily driven by domestic demand, with consumption and investments contributing a significant 70% of overall economic activity.

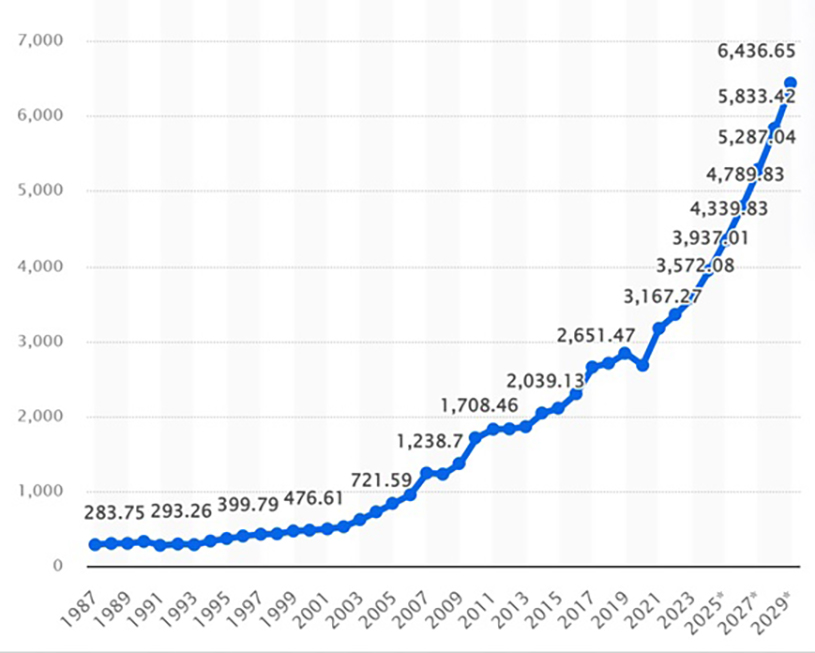

According to the following economic indicators, India’s economy is rapidly growing and will soon be the third biggest in the world.

Economic Indicators

GDP per Capita: The average income per person in India is estimated to be 2.85 thousand US dollars.

GDP per Capita: The average income per person in India is estimated to be 2.85 thousand US dollars.

Share of Global GDP: Based on purchasing power parity, India is set to account for 7.75% of the world’s GDP in 2024.

Real GDP Growth: According to the IMF, India’s economy, hailed as “the world’s fastest-growing major economy,” is projected to grow by 7% in 2024, which is an increase from the previous projection of 6.8%.

GDP per Capita in Purchasing Power: When considering purchasing power, the per capita income is projected to be an impressive 9.89 thousand international dollars.

GDP at Current Prices: The Indian economy is expected to reach a record high of 4.11 trillion US dollars.

Inflation Rate: Inflation in India is expected to remain moderate, around 4.6%.

End-of-Period Inflation Rate: By the end of 2024, Indian consumers can anticipate an inflation rate of 4.4%.

Current Account Balance: The current account deficit is narrowing and is expected to be -74.174 billion US dollars.

Business activity booming: A recent survey shows India’s business activity at a 14-year high, driven by strong demand, rising employment, and lower input costs.

Strong foreign exchange reserves: India boasts healthy foreign exchange reserves exceeding US$643 billion as of April 2024.

Strong foreign exchange reserves: India boasts healthy foreign exchange reserves exceeding US$643 billion as of April 2024.

PE-VC investment on the rise: India attracted a significant US$49.8 billion in private equity and venture capital investments in 2023.

Exports on an upward trend: Merchandise exports reached US$41.68 billion in March 2024, contributing to a total of US$437 billion for the financial year ending March 2024.

Science publication powerhouse: India ranks 3rd worldwide in the number of scientific publications.

GST revenue surges: India’s Goods and Services Tax (GST) collection hit the second-highest ever in March 2024, at US$21.35 billion.

FDI inflows remain strong: Foreign direct investment into India has steadily grown, reaching a cumulative total of US$971.52 billion by December 2023.

Industrial production maintains momentum: India’s industrial sector continues to see growth, with the February 2024 Index of Industrial Production (IIP) reaching 147.2.

Industrial production maintains momentum: India’s industrial sector continues to see growth, with the February 2024 Index of Industrial Production (IIP) reaching 147.2.

Inflation under control: Consumer Price Index inflation remained moderate at 5.69% in December 2023.

Foreign and domestic investors: Foreign investors injected nearly US$9.67 billion between April and July 2023-24, while domestic investors offloaded US$540.56 million during the same period.

Source: IMF, World Bank and RBI

ROAD AHEAD

The Indian economy maintained its positive momentum in the first half of the financial year 2023-24 (FY24). This positive outlook is supported by several factors:

Sustained Growth: The economic growth momentum from the first quarter continued into the second quarter. Additionally, high-frequency indicators continued to perform well in July and August of 2023.

Sustained Growth: The economic growth momentum from the first quarter continued into the second quarter. Additionally, high-frequency indicators continued to perform well in July and August of 2023.

Strong External Sector: India’s position in the external sector is comparatively strong, reflecting a positive outlook for economic growth and rising employment rates. This strength is further bolstered by India’s ranking as the 5th largest recipient of foreign direct investment among developed and developing nations in the first quarter of 2022.

Increased Government Investment: The Indian government’s unwavering support for capital expenditure played a key role in the economic story of the first half of FY24. Capital expenditure in 2023-24 witnessed a significant increase of 37.4% compared to the same period in the previous year. This increase was driven by a steep rise in the capital expenditure outlay allocated in the 2023-24 budget. The budget saw a 37.4% increase in capital expenditure outlay, reaching Rs. 10 lakh crore (US$ 120.12 billion) compared to Rs. 7.28 lakh crore (US$ 87.45 billion) in the previous year’s revised estimate.

Shift Towards Higher-Quality Spending: There was a clear shift towards higher-quality spending in the current year. This is reflected in the ratio of revenue expenditure to capital outlay, which decreased by 1.2%. This decrease indicates a prioritization of capital expenditure over revenue expenditure.

Rising Capital Spending: The rise in capital spending can also be attributed to stronger revenue generation. This improved revenue generation stemmed from factors including better tax compliance, increased profitability of companies, and rising economic activity. In February 2024, the Finance Ministry announced the total expenditure for the Interim 2024-25 budget, estimated at US$ 571.64 billion, with US$ 133.27 billion allocated for capital expenditure.

Rising Capital Spending: The rise in capital spending can also be attributed to stronger revenue generation. This improved revenue generation stemmed from factors including better tax compliance, increased profitability of companies, and rising economic activity. In February 2024, the Finance Ministry announced the total expenditure for the Interim 2024-25 budget, estimated at US$ 571.64 billion, with US$ 133.27 billion allocated for capital expenditure.

Resilient Growth and Export Performance: India’s economic growth has shown resilience despite the challenges posed by the global pandemic. This resilience is further accentuated by the country’s strong export performance. As of April 2023, India’s merchandise exports witnessed the second-highest YoY growth rate of 8.39%, while service exports saw an even more impressive growth of 29.82%. Additionally, with a reduction in port congestion, supply networks are being restored.

Inflationary Pressures on the Decline: The reduction in CPI-C inflation observed since June 2022 reflects the positive impact of various measures. By September 2023 (provisional data), CPI-C inflation had fallen to 5.02%, down from 7.01% in June 2022. This decline in inflation can be attributed to a combination of factors, including proactive government actions, flexible monetary policy, and a softening of global commodity prices and supply-chain bottlenecks. Overall, inflationary pressures in India appear to be on a downward trend.

It’s time for Morgan Stanley to revise their 2013 economic prediction and elevate the Indian economy from the “fragile five” to “the top five”. I am not holding my breath for the New York time to report this positive change in India’s economy.

About the Author

Dr. Sunanda Basu is a distinguished economist who earned her PhD from a prestigious university in the United States. She has been a respected professor for several years, contributing significantly to the field of economics. Dr. Basu’s research focuses on macroeconomic policy and international trade, earning her recognition and accolades in academic circles. She is known for her engaging teaching style and dedication to mentoring students. Dr. Basu continues to influence the next generation of economists through her innovative research and passionate instruction. She can be reached via email drbasu@deshvidesh.com