India Inc. on Global Acquisition Sprees

The history of India is filled with instances about how foreign traders came to this land in search of prosperity and turned hay into gold. Indian shores saw the footprints of the Spanish, French, Portuguese, Dutch, and Chinese traders, though it was ultimately the British who were able to convert their business aspiration into a political one and eventually ruled the country for nearly 200 years, as a part of their colonial empire. Even after independence, Indian trade and business has mostly been on the receiving end – having taken over or merged with giant international corporations, who exploited the local resources for their own benefit.

The history of India is filled with instances about how foreign traders came to this land in search of prosperity and turned hay into gold. Indian shores saw the footprints of the Spanish, French, Portuguese, Dutch, and Chinese traders, though it was ultimately the British who were able to convert their business aspiration into a political one and eventually ruled the country for nearly 200 years, as a part of their colonial empire. Even after independence, Indian trade and business has mostly been on the receiving end – having taken over or merged with giant international corporations, who exploited the local resources for their own benefit.

After the opening up of the economy and in this ongoing era of globalization, the tide has turned 360 degrees. It is now Indian business conglomerates that have set forth a new vision and are slowly and steadily making deep inroads overseas – by buying out foreign companies and making their business expand sans frontiers.

In the primary period, India Inc.’s outbound acquisitions were mostly to European companies, but gradually, trade moved further west, and the United States became the most preferred buying spot. Statistics reveal that the largest proportion of outbound deals in 2005 occurred in Europe, followed by North America. The increased interest in U.S. acquisitions by Indian firms comes against a broader backdrop of accelerated acquisitions by corporate India made up of companies in various places. In the first nine months of 2006, for example, Indian companies announced 115 foreign acquisitions with a value totaling $7.4 billion – the majority being in the U.S.

In the primary period, India Inc.’s outbound acquisitions were mostly to European companies, but gradually, trade moved further west, and the United States became the most preferred buying spot.

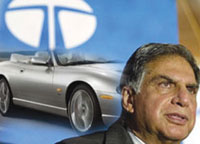

There have been a number of noteworthy acquisitions by Indian companies of U.S. firms in the new millennium. They include: Reliance Gateway Net’s acquisition of Flag Telecom (2003) for $191.2 million; the purchase by Mumbai-based VSNL of Tyco Global Network, a submarine cable network, from Tyco International, based in New Jersey, for $130 million (2004); and the acquisition by Bangalore-based Scandent of Cambridge Services Holding, a global outsourcing firm headquartered in Greenwich, Connecticut, for $120 million (2005). Another major U.S. acquisition took place in February 2006 when GHCL, based in the state of Gujarat, India, acquired Dan River, a Danville, Virginia-based maker of home textiles for $93 million. Units of the TATA Group are also in the act. Tata Coffee paid $220 million to buy Eight O’Clock Coffee, a venerable U.S. brand, and Tata Tea paid $677 million for a 30% stake in Glaceau, a maker of vitamin water in Whitestone, New York.

Interesting to note though, that there is a general premonition among the Indian public that due to the opening up of the economy, U.S. multinationals will be vying for space in India and are keen to own stakes in Indian companies. In reality, the picture is indeed just the opposite. For example, in 2008, there were three U.S.-bound acquisition deals over $1 billion in the first six months – the Tata Chemicals acquisition of General Chemicals Co. for $1 billion, GMR Energy Limited’s purchase of 50% equity in InterGen for $1.1 billion, and Sterlite Industries (India) Limited announced a bid for Asarco LLC valued at $2.6 billion. Moreover, there were about 17 such acquisitions in the given period catering exclusively to information technology.

An account of the notable deals in recent times cannot be complete without mentioning two in particular – India’s steel giant Essar Steel Holdings Limited negotiated a $669 million cash buy-out offer to acquire Steelmaker and distributor Esmark Inc. with an objective to make it a low cost, technologically advanced steel producer; on the other hand, the now-fabled deal between Dreamworks Inc. and Anil Ambani’s Reliance Group (ADAG). The Reliance deal, which is valued at $500 million, will enable Dreamworks and its principals David Geffen, Steven Spielberg, and Stacey Snider to create a stand-alone production company.

An account of the notable deals in recent times cannot be complete without mentioning two in particular – India’s steel giant Essar Steel Holdings Limited negotiated a $669 million cash buy-out offer to acquire Steelmaker and distributor Esmark Inc. with an objective to make it a low cost, technologically advanced steel producer; on the other hand, the now-fabled deal between Dreamworks Inc. and Anil Ambani’s Reliance Group (ADAG). The Reliance deal, which is valued at $500 million, will enable Dreamworks and its principals David Geffen, Steven Spielberg, and Stacey Snider to create a stand-alone production company.

In fact, only the big deals earn a mention in the newspapers, but there are a lot of small- and mid-sized opportunities going on in the $20 million to $60 million range. Such mergers and acquisitions (M&A) are here to stay for the next few years, especially in the field of industrial products, packaging, auto components and textiles, as well as IT and capital goods.

India’s steel giant Essar Steel Holdings Limited negotiated a $669 million cash buy-out offer to acquire Steelmaker and distributor Esmark Inc. with an objective to make it a low cost, technologically advanced steel producer; on the other hand, the now-fabled deal between Dreamworks Inc. and Anil Ambani’s Reliance Group (ADAG).

India’s steel giant Essar Steel Holdings Limited negotiated a $669 million cash buy-out offer to acquire Steelmaker and distributor Esmark Inc. with an objective to make it a low cost, technologically advanced steel producer; on the other hand, the now-fabled deal between Dreamworks Inc. and Anil Ambani’s Reliance Group (ADAG).

The Reliance deal, which is valued at $500 million, will enable Dreamworks and its principals David Geffen, Steven Spielberg, and Stacey Snider to create a stand-alone production company.

Now, the big question is: what is propelling the Indian Companies to go on such a shopping spree for U.S. firms? The reasons for this trend are numerous, an important one being the Indian company’s changing mindset over the function of business. Indian firms in various industries, most visibly in information technology, but also in areas like auto components, the energy sector, and food products have been slowly building up to become emerging multinationals. Observing the management and business practices employed by global firms through their outsourcing activities in India, these Indian firms are gearing up for a similar strategy to fine tune their operations in the global market.

Now, the big question is: what is propelling the Indian Companies to go on such a shopping spree for U.S. firms? The reasons for this trend are numerous, an important one being the Indian company’s changing mindset over the function of business. Indian firms in various industries, most visibly in information technology, but also in areas like auto components, the energy sector, and food products have been slowly building up to become emerging multinationals. Observing the management and business practices employed by global firms through their outsourcing activities in India, these Indian firms are gearing up for a similar strategy to fine tune their operations in the global market.

At the same time, Indian firms are becoming more profitable, the result, in part, of an ever-booming economy, and they can access significantly more capital than in the past. There is also a lot more cash available in the Indian market than previously. Many companies are under leveraged, and they don’t have much debt. Their capacity to borrow from others is a lot better and hence, they can borrow sizeable amounts of cash, which can be deployed for acquisitions.

At the same time, Indian firms are becoming more profitable, the result, in part, of an ever-booming economy, and they can access significantly more capital than in the past. There is also a lot more cash available in the Indian market than previously. Many companies are under leveraged, and they don’t have much debt. Their capacity to borrow from others is a lot better and hence, they can borrow sizeable amounts of cash, which can be deployed for acquisitions.

Yet another factor spurring the acquisition spree is that Indian companies have greater power to raise money in U.S. capital markets because investors have grown more familiar with businesses in India.

A number of Indian firms see global markets, not the domestic market, as their chief pathway to growth. There is also an element of pride in Indian firms being able to make acquisitions in America, and there is a growing belief that if you are a large company, you must have a good presence in the U.S. This signifies a growing confidence among India Inc. companies as they have come of age and are better managed than they were 10 years ago. To acquire U.S. companies, they need to have a good capital base and fundamentals in place. This is a sign that Indian companies can truly compete on a global basis.

A number of Indian firms see global markets, not the domestic market, as their chief pathway to growth. There is also an element of pride in Indian firms being able to make acquisitions in America, and there is a growing belief that if you are a large company, you must have a good presence in the U.S. This signifies a growing confidence among India Inc. companies as they have come of age and are better managed than they were 10 years ago. To acquire U.S. companies, they need to have a good capital base and fundamentals in place. This is a sign that Indian companies can truly compete on a global basis.

Yet another factor spurring the acquisition spree is that Indian companies have greater power to raise money in U.S. capital markets because investors have grown more familiar with businesses in India.

India has good foreign exchange reserves and Indian companies that have acquired overseas firms sell products in dollars and take part of that money to India, some of which ends up in government coffers. As a result, the government has made a number of policy changes to encourage the phenomenon and made it easier for firms to acquire overseas companies by removing barriers to M&A deals.

While the going has mostly been successful until now, there is certainly room for improvement and reasons for being cautious in approach, because enthusiasm is no guarantee of a successful merger. Post-merger integration is a vital component of a successful union and key to final accomplishment. Post-merger, companies encounter major problems including a different culture, managerial norms, compensation, and regulatory environment, all of which are often not attended to properly and become a major barrier that firms face as they try to operate as one entity.

While the going has mostly been successful until now, there is certainly room for improvement and reasons for being cautious in approach, because enthusiasm is no guarantee of a successful merger. Post-merger integration is a vital component of a successful union and key to final accomplishment. Post-merger, companies encounter major problems including a different culture, managerial norms, compensation, and regulatory environment, all of which are often not attended to properly and become a major barrier that firms face as they try to operate as one entity.

Overall, it is evident that with proper planning and strategy implementation, the present run of India Inc. in buying out foreign firms, including those that are U.S.-based, will continue. Indian companies will also continue to earn vital pride and prestige as a fast-emerging global economic giant, one that has the will, power, and resources to take on the world.