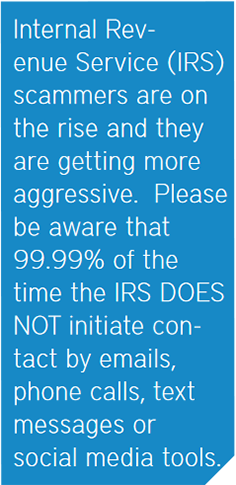

IRS Scammers

| IRS SCAMMERS |

| By Nirali Chokshi, CPA |

|

|

*Ring Ring* Pretend IRS: Yes, this is the IRS. You have $5,000 due for your 2014 taxes. Either pay by end of business day or I’ll have the cops arrest you. You: Get lost. That is what I hope your response would be if you ever get one of these calls. |

|

|

|

Typical ways scammers try to take your money (but not limited to):

If you get any of the above, mention your accountant will contact them and get a call back number. The main point to understand is that the IRS will not demand money without a chance to question or appeal the decision. In the case you do think you owe money, first contact your accountant and inform them of the situation. The IRS specifies the taxpayers to make a payment to the “United States Treasury” by following the directions on your real notice or the instructions on this website: https://www.irs.gov/payments (Please note in https, the S must be written there (stands for ‘secure’); and it is .gov not .com. Very important distinctions!) In conclusion, don’t get scared and never give out your personal information right away. Validate the person first, ask for a call back number, their identification badge and don’t trust the caller ID name displayed on the phone. |

|

About Nirali Chokshi, CPA About Nirali Chokshi, CPA

Nirali is a CPA working at her family’s accounting firm Chokshi Accounting & Tax Services in Orlando, FL. She graduated with her Masters from University of Central Florida in 2009. |